Avoiding outstanding invoices? Get paid up to 30% faster with these 10 tips

Do you also lie awake at night because of outstanding invoices? Quite right. Every invoice that is not paid, or paid late, can jeopardize the existence of your company.

Are you tired of waiting or begging for your money? Then read our 10 tips for avoiding outstanding invoices.

After all, collecting your own money is faster and cheaper than using a collection agency. Extra bonus: customers who pay on time increase the quality of your sleep.

Study: late payments are no laughing matter

The figures from a 2021 study by Unizo and Graydon Belgium show a not so pretty reality of the Belgian B2B market:

30% of invoices are paid late, or not at all.

1 out of 10 invoices are honored at least 90 days after the due date and in some cases not at all.

For the total amount that is then missed, you can easily make a few hundred thousand beautiful trips around the world. In five-star hotels. Breakfast included.

For the B2C market, the situation is not entirely problem-free either, but this study is mainly focused on B2B.

The study is about Belgium.

Bad payers are like speed cameras. You run into them everywhere. They leave you on the brakes. They can cost you money.

An outstanding bill doesn't really hurt, right?

Wrong.

It is true that one sleepless night is quickly forgotten.

A week, or month of no sleep. It will give you bags under your eyes.

If you sometimes, regularly, or constantly have to deal with unpaid and outstanding invoices, you really should be worried.

That doesn't just apply to invoices that customers have to pay you, by the way.

Paying your own invoices late

If you pay your suppliers late, it can cost you dearly:

In the worst case scenario, you run the risk that your supplier stops working with you completely. There you are without products or services to resell.

In a less bad case, you lose (part of your) discounts and favored rates. In other words, to get the same revenue, you have to increase the price of your products or your services. Or you have to sell more volume than before.

Extra painful, of course, if that is the result of customers paying you late.

Are you paying government and administrative services late? Then you are guaranteed to be fined for this.

Paying VAT late to the administration? Fine.

Social security late payment? Fine.

You have to pay extra because you can't pay your bills. Ok, that makes sense. But all this because your clients don't pay their bills. That's absurd, isn't it?

You could have invested the fines for your late payments much smarter. To pay yourself a salary, for example. Or to invest in the growth of your business.

Late payments inhibit your growth

Are you planning to hire new employees, buy machinery or equipment? Or do you want to hire a freelancer to expand your range of services?

Without money, this becomes difficult. You can, of course, apply for a loan from your bank. But you have to pay that back. With interest.

Outstanding and unpaid invoices put you in a downward spiral.

Time to break through this. Or to prevent it. But how do you do that?

Unfortunately, there is no formula that offers a 100% guarantee of getting your customers to pay on time.

Except one...

Entrepreneurship is daring to take risks. But it's also about avoiding risks.

Here are 10 tips to avoid outstanding invoices:

The advance invoice: never again wait for your invoices to be paid

Definitely don't make mistakes in your invoices (and quotes).

#1 The advance invoice: never again wait for your invoices to be paid

The only way to really be sure you will get your money on time is to have your clients pay you in advance.

For projects in construction, this is normal practice.

If it were really that simple, every business owner would just do it anyway. Then we wouldn't even have to write this article. And you wouldn't be reading this.

So why doesn't everyone ask for advance billing?

Answer: there is still a big psychological barrier to asking for money up front.

You have to convince your client to agree to this. And that requires a lot more effort than following up on your outstanding invoices.

Asking your existing customers for an advance?

Existing customers know and trust you. They know what to expect from you. You know what you have to offer them. That's why you always have your customers at your fingertips.

If you've never asked them for an advance before, it will seem strange if you suddenly start doing so.

Why do I suddenly have to pay an advance when I never had to before?

Do you have a financial problem?

Is it still wise to order from you?

All questions you won't hear, but they will certainly be asked.

All questions that should not prevent you from trying anyway.

When you purchase a product, or service, from a third party and resell it, you often have to pay immediately.

Is that not the case? Even then, the payment period of your supplier's invoice may be much shorter than yours. And so you have to advance the money for your customer.

Do you really want to be the free bank for your customers?

Chances are slim that you will actually become one. At least, if you dare to ask for an advance.

How do you best ask your customers for an advance?

You have established a relationship of trust with your customers. This makes it easier to approach them personally and explain in advance your rationale for your advance billing.

Of course, you don't have to formulate your motive ("I'm not a bank after all") to your client in this way.

A simple phrase or wording can sometimes work wonders.

"In order to guarantee that the order will be delivered on time, I am exceptionally forced to ask for an advance payment."

You don't need to spend many more words on that. It is completely beyond your control AND it is a one-time thing.

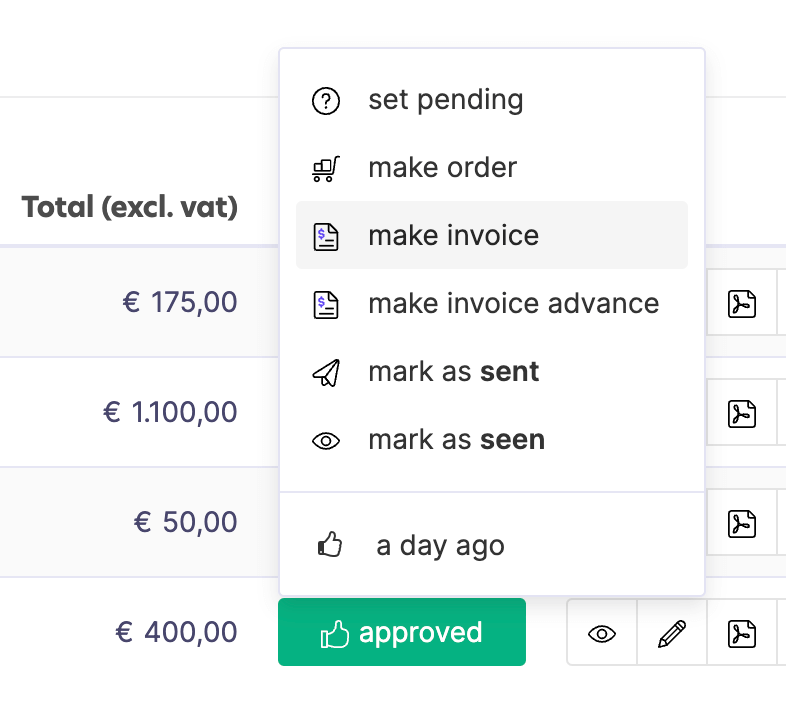

All you have to do is prepare an advance invoice. Once this is paid, you can make an order form.

Then print a packing slip and you're done.

Or you can present your customer with a dilemma:

"The product is almost sold out. The last thing I want is to have to offer you an inferior quality alternative. Should you be able to decide today, I will place the order and provide you with an advance invoice for this."

You don't even ask your customer if this is okay. The choice is his or her own: quality or an inferior alternative? The former costs money, but you have to pay for it up front.

A tad daring, but worth a try.

Dare to ask new customers for an upfront payment

This is a tricky one.

Are you happy to pay strangers in advance without any guarantee of delivery or performance? No. Neither do your potential customers.

The biggest condition for success is by exuding trust. But that's easier said than done.

What certainly fails is a direct approach:

If you want to become a customer, you have to pay up front.

A little more chance of success can be achieved with an apologetic and explanatory approach:

In the past, we have unfortunately experienced on several occasions that some customers do not take payments very closely. That's why we ask every new customer for an advance invoice.

Unlike with your existing customers, it is more difficult for new customers to work with an advance invoice. One sentence will not suffice.

There are many factors that determine whether advance billing for new customers can work for you. We list them briefly.

Tips: asking for an advance invoice is easier if you can answer "yes" to 1 of these 4 questions

Are you an exclusive provider of services or products?

Can you reassure new customers with experiences of other customers who did agree to pay in advance?

Do you offer an extra guarantee in case the customer is not satisfied? Not satisfied, money back, for example.

Is the amount of your advance invoice not the full sum, but covers (only part of) your costs?

Are you really not getting the advance invoice sold? Don't panic.

Fortunately, there are other ways to leave the gates of hell of outstanding invoices slightly ajar.

So be sure to read on.

Conclusion: An advance invoice is your only guarantee of receiving (part of) your money on time. If the client doesn't pay, you don't provide any services or products. You may lose a potential client, but not time and money.

#2 Get your invoice paid just before the (on) delivery or works

If advance billing doesn't work for you, this is the second best strategy to get your invoice paid on time.

You want your money. Your customer wants the order. Both of you are (rightly) afraid that the other party will not keep its word. So why not complete both transactions at the same time?

The main difference with an advance invoice, is that you can lose time and/or money with this strategy. But it's never the full amount, or all of your time.

Some examples:

Avoiding outstanding invoices as a creative freelancer

Click click.

Your photo shoot, translation, website, logo,... is done. Here you can see a low resolution, small selection, test version.Are you satisfied?Pay and I'll get you the final product. It works just as well when you work with your hands:

Avoid outstanding invoices as a roofer, handyman, painter,...

Ding dong.

The roofer is at the door. I'll make sure it stops raining inside. But before I start on your roof, I'd like to see an account statement that you paid.

Or when you sell experience and advice, such as bookkeepers and accountants:

Avoiding outstanding invoices as a consultant

Click click.

Attached you will find my initial findings. Want my full advice and analysis in your mailbox? No problem, but pay first.

In all these cases, your dust must have made some effort.

If your client doesn't pay in the end, somehow you lose. Not nice of course, but much less painful than when you are the losing party.

Tips for interim invoicing

In your quotation, make it clear in advance that this is your usual way of working. That way you put the customer at ease. And you avoid unpleasant surprises afterwards.

Do only a small part of your project. It makes no sense to translate 100 pages and then send an invoice hoping your client will want to pay for the other 99.

Be sure to read the following tip.

Conclusion: Pay on delivery is win-win. Or at worst loss-loss. But never loss-win.

#3 Interim invoices and milestones: get your money in steps

An installment payment is your third best guarantee to avoid outstanding invoices and defaulters.

Whether or not combined with an advance invoice. That's up to you.

The idea is simple. And as is often the case with simple ideas: it works.

Something done?

Invoice.

Invoice paid?

Address the next part.

If you do projects for your clients, it is very common to make them pay when a certain milestone is reached. No one will give you a hard time about this. And you can sleep on both ears.

A few examples make the link between projects and billing immediately clear.

Interim billing as a web designer

As a web builder, you can send your clients an invoice, for example:

when the design is finished

the website is online

30 days after the launch

Or another example.

Interim billing in the construction industry

Summer is coming. Time to build a pool at your client's house. And to start billing your client

Plans ready? Invoice.

Excavation done? Invoice.

Pool filled? Invoice.

No matter what services you provide, there is always an opportunity to apply the above yourself.

Nothing obligates you to do that for every project, or every client.

Additional tips for interim invoices

It is important to include these agreements in your quote up front.

Choose logical milestones that your client can easily imagine. That sells easier.

Don't let the payment deadlines of your invoices overlap with the deadlines of your milestones. In other words, make sure your customers have to pay before you reach the next milestone. That way, you avoid having to follow up on outstanding invoices while you're already working on the next step.

Even for projects you run based on worked hours, this can work. For example, send an invoice each week for your hours performed.

Apply this only to larger projects. Setting up interim invoices for 100 euro projects really makes no sense.

Are you already using CoManage? Then you can set up periodic invoicing for your projects and milestones. That way you won't forget to invoice yourself on time.

Conclusion: By letting your client pay in pieces, you build a relationship of trust during the project itself. This works very well. Both parties have a stick. Does it still go wrong? At least you won't have lost all your money and energy.

#4. Put your terms and conditions on your invoice. Always.

At a flea market, you can shake hands to seal a deal. In the business world, too, but that's not the smartest way to avoid misunderstandings and misery.

That is not to say, however, that bargaining is unusual. On the contrary.

This is also shown in the study by Graydon Belgium that we mentioned above:

B2B invoice terms and negotiations

32% were imposed by the customer

65% were balanced negotiations

Government billing terms and negotiations

50% were imposed by the government

50% were balanced negotiations

B2C invoice terms and negotiations

50% were determined by the entrepreneur

28% were balanced negotiations

22% were determined by the customer

Do yourself a big favor NOW.

Look at these numbers again very carefully.

No matter what kind of clients you have, there will always be someone who does not blindly accept your terms.

And herein lies two great opportunities for you.

Opportunity 1: Negotiate your supplier's terms

You read it right. Negotiating in the business world is normal.

So why not review the terms of sale of your current, or new, suppliers?

Maybe you can negotiate more favorable purchase terms?

That doesn't necessarily have to be a lower price. Longer payment terms can also work in your favor.

Opportunity 2: Don't regard your invoice terms as the law

Be flexible. Both with your current and new customers.

Listen to their concerns and possible objections. But adjust your terms only when it fits within your capabilities.

Your flexibility creates goodwill.

A deal you make together has a better chance of being honored. The corresponding invoice might get paid faster.

Tips for your invoice terms

Include your terms and conditions in your quotations and invoices. Always.

Ask your customer explicitly if these conditions fit within the expectations.

But never explicitly state that you are open to negotiation. It gives a weak impression and is guaranteed to cause trouble.

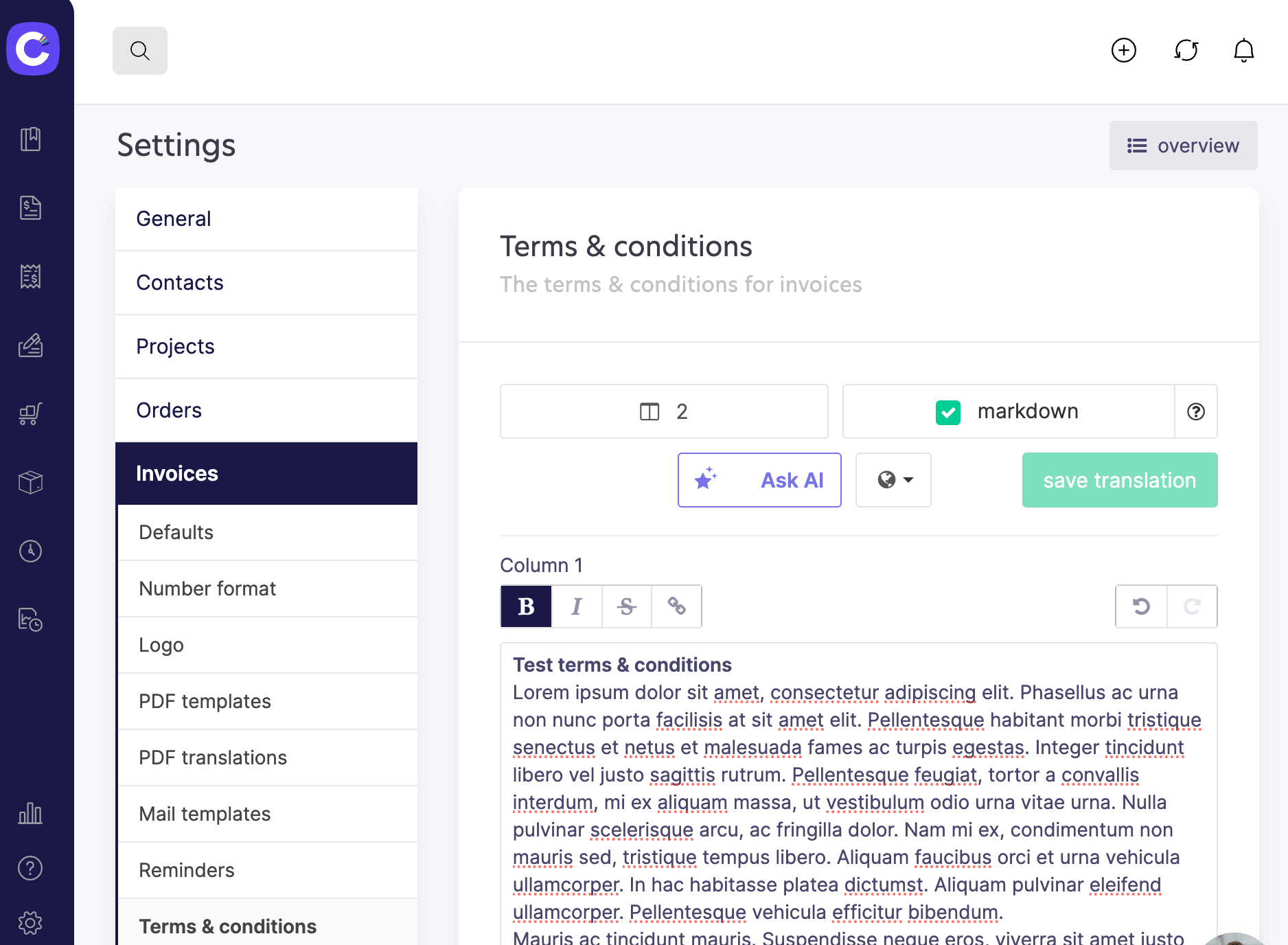

Do you use CoManage? Then you only have to enter your conditions once. So you never forget to send them with your offers and invoices.

Conclusion: Tailoring agreements to your customer creates a bond of trust. Trust can lead to faster payments.

#5. Definitely don't make mistakes in your invoices (and quotes)

Lawyers have a nasty reputation for making money on commas forgotten somewhere, or misplaced.

However, your clients don't have to be lawyers to make money on mistakes you make in your invoices or quotes.

In fact, they don't even have to notice the mistakes. A mistake in your terms and conditions, bids, or invoice can cost you money.

So what do mistakes have to do with your outstanding invoices?

The answer is: a lot.

An invoice that contains errors can be contested more easily. That's an expensive word for a refusal by your customer to pay the invoice.

A miscalculation in the price, VAT, discount,... not only gives an unprofessional impression. It is also the fastest way to extra administration and communication. Without errors, you can avoid this and thus clear your outstanding invoice faster.

Unless you have a numbers profession, administration is certainly not the most attractive aspect of your existence as an entrepreneur.

Mistakes are easily made. Especially when you have to prepare a quotation or invoice in the evening or at the weekend.

Tips for invoicing without mistakes

Regardless of how you run your business, organize your administration neatly and clearly: prices, customers, offers, invoices.

Don't make calculations on your smartphone or a calculator. Computers are much better and faster at this than you are.

Do you use CoManage? Make smart use of the products module. Enter the prices for your services or products 1X and CoManage calculates everything on your invoices and quotations.

Conclusion: Everyone makes stupid calculation mistakes. Except computers. They are made to calculate in your place.

#6. Invoice today, not in a month

An invoice you don't send out is not an outstanding invoice.

But the effect is exactly the same as an invoice that is paid late: your account is not replenished.

Say your payment term is 14 days.

But you don't invoice until 20 days after you complete your work.

Then you're actually giving your client 34 days to pay.

The real problem is much deeper than that:

You're not even giving your clients a chance to pay you. Why anyway? Maybe they want to pay on time.

You're sending the obvious wrong message: "Don't worry about payments. Payment is not in a hurry, I'm late with my paperwork myself. And you can guess that following up on my invoices is not going smoothly either".

So with procrastination, you unconsciously create an expectation pattern that is very difficult to break later.

Do you wait to prepare invoices until the end of the month? Or until when you have time and feel like it?

Stop this.

Immediately.

Tips for faster invoicing

Absolutely make it a habit to invoice as soon as possible. Project finished? Invoice out the door.

Sending invoices by mail is really out of date. Create and send your invoices digitally.

Already using CoManage? Turn your quotations into an invoice with one click.

Conclusion: Invoicing later is getting paid later. The timing is entirely up to you.

#7. Don't forget your payment term and due date

There is a good reason why there is an expiration date on the eggs you buy at the supermarket or convenience store.

After this date you still feel like having an omelet? Then you better buy new eggs.

The expiration date is also a warning on your bill. Paying after this date? You won't get salmonella, but it may incur additional administrative costs.

Just as you know about eggs, everyone knows what the due date of an invoice means.

And that's just the problem. What goes without saying, you don't see.

List the due date of your invoice 2X

There's absolutely no harm in clearly stating the due date again at the bottom of your invoice. Whether or not along with the penalty a late payment will cost.

How best to formulate that? Plenty of choice:

Business payment request

This invoice is due no later than ....

Or something softer perhaps?

Friendly request for payment

We kindly request that you pay this invoice by ...

Or a little more submissive?

Submissive payment request

We would appreciate it if you would pay this invoice before ...

Or just leave no doubt?

Threatening language on your invoice

Avoiding an administrative fine? Pay this invoice before ...

Or why not try using humor?

Playful tone

Our accountant is a difficult man. Every time one of our clients pays late, he calls us. He then goes on a rampage on the phone. This is not really pleasant for us. Do us a favor, pay your invoice before .... That way we here in the office have less stress and can focus better on you and our other clients.

The way you phrase something can already make a big difference.

Just make sure the tone you use is appropriate for your firm. A law firm is unlikely to use the last example on their invoices.

Tips for your invoice payment terms

In addition to a payment term, be sure to include a concrete due date.

Avoid the formula "within X business days. That confuses customers. And some tempted to pay late: "Ah, but there's a public holiday in that period. So I can safely pay an extra day later".

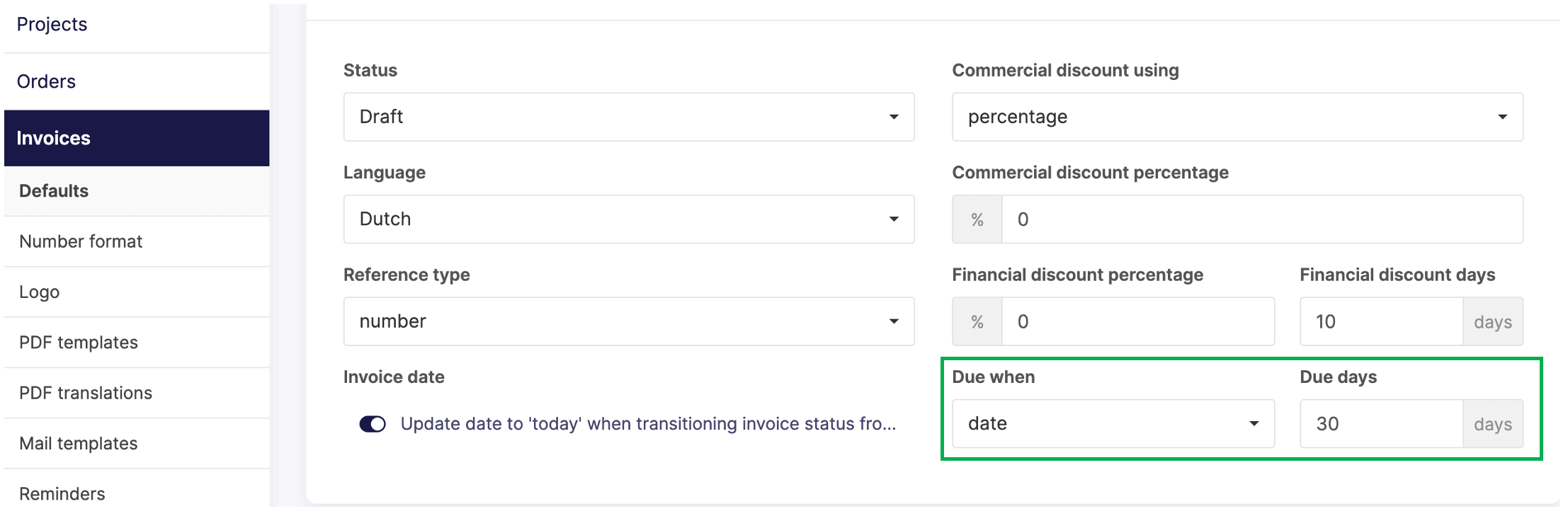

Are you using CoManage? You can set a default payment term for your invoices. Each invoice will then automatically include the due date and payment term.

The payment due date is listed. Twice. Now just hope your customers don't forget.

Or that you yourself don't forget....

Conclusion: Leave no doubt about the date by which your invoice must be paid.

#8. Remind your customers of their outstanding invoices

No matter what you try. Sooner or later you will always have a customer who "forgets" to pay on time.

You can't avoid that.

What you can (and should) do is make sure you yourself don't forget when which customer should pay how much.

When. Which. How much.

Can you remember all that about your customers?

Do you want to remember all that from your customers?

Remind yourself of ... your payment reminders

You can write a note in your paper calendar. Or put a reminder in a digital calendar, such as Google's.

But that's not enough. As business owners, you're busy.

Payment reminder day is coming up. Of course, you're with a client just that day. Or you're up against a deadline.

Busy, busy, busy, busy.

Dare to demand your money

A much bigger problem is that business owners are often afraid to send a reminder invoice.

Strange if that is the case with you: you want to take risks ánd yet you are afraid to ask for your money.

Therefore: dare to ask for what you are entitled to.

Especially when you have applied the above tips, you are in a strong position.

Your client has agreed. You have been clear and correct. Now it is up to your client to fulfill his part of the agreement.

You won't lose good customers by reminding them of the agreements. Bad ones might. But you'll lose those sooner rather than later.

Tips for payment reminders

Be polite in your first reminder. It's perfectly possible that your customer really did forget to pay.

Don't send your reminders on the due date itself. It's possible that your customer has paid, but the payment is still on its way to your account.

Nothing prevents you from reminding your customers before the due date.

No response after your first reminder? Track your outstanding invoices and reminders strictly. Send the second one a week later. Or sooner.

Do you use CoManage? Payment reminders can be sent automatically. You can set this up separately for each invoice. You can also adjust the text for the reminder e-mail before you send the reminder.

Reminding people of their obligations is unfortunately also part of the job sometimes.

Conclusion: Send payment reminders with as much passion as you feel for your real job. It will make you money in the end, too.

#9. Bring overview to your bill administration

Do you have to open all the cabinets in your kitchen every day to see where the milk is? Probably not.

It's the same with invoices. If you know where they are, you don't waste time.

What is manageable for you may be pure chaos for a colleague or partner.

Do you have to look up your outstanding invoices in your mailbox?

If you're sick, does your colleague have access to your mailbox?

Do you keep an overview of your invoices in an excel file?

And are you sure it's up-to-date?

Do you count on your accountant to remind you every quarter that certain clients have yet to pay you?

Back to the kitchen for a moment...

Just because you know the butter is in the fridge doesn't mean you see it right away.

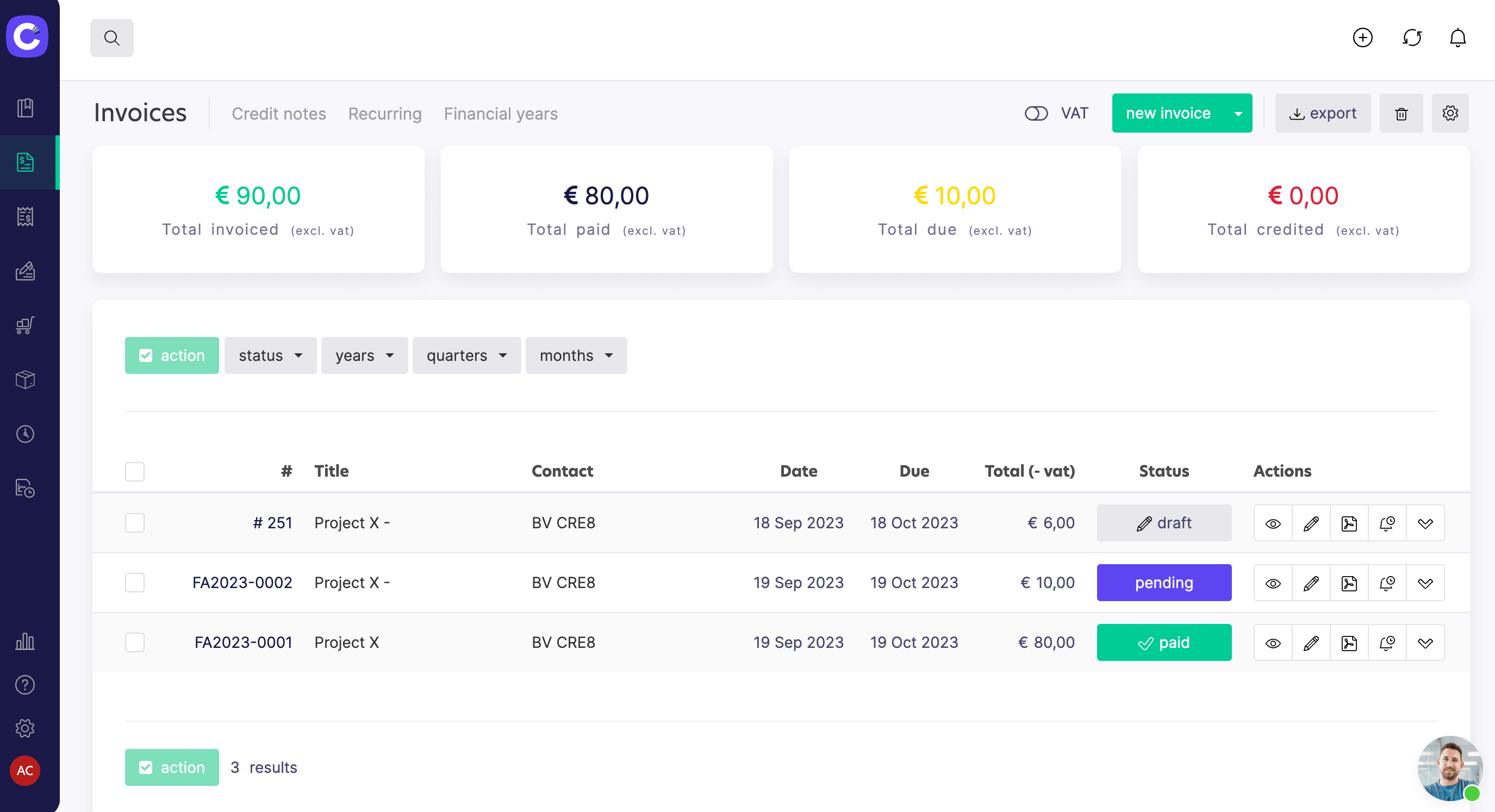

It's the same with invoices, too. If you can see at a glance which invoices are still outstanding, you know which ones urgently need your attention.

Tips for orderly invoice administration

By keeping all your invoices together in a central place, you save time. Both in creating, sending, following up and submitting them to administrative services or your accountant.

Do you use CoManage? Then you can find your invoicing in one program. And immediately see which invoices still have to be paid. And how much money is left in your account.

#10. Cash discounts: reward customers who pay well on time

Discounts are a popular way to boost sales.

But you might as well offer a discount only when the deal is already done.

This type of discount is so special that it even has a special (accounting) name: discount cash.

What is the advantage of giving a cash discount?

With a cash discount, you don't necessarily sell more.

But it does make it possible to collect your invoices faster.

On the other hand, you pay a price for it. To discount is always to earn less.

That's the dilemma on your side. Comfort yourself, your customer faces a choice, too.

What is the advantage of taking a cash discount?

If you don't announce the discount cash in advance, your customer will be pleasantly surprised. That in itself is sometimes enough to promptly pay the invoice.

But in addition, your customer is also in a dilemma.

I get a discount. Whew!

But then I have to pay now. Hmmm.

Or should I wait and pay later. But then pay more? Euh...

Whether the discount deal goes through depends entirely on your customer. And on the clock.

Which is Ticking.

Slowly.

Mercilessly.

Further...

Cash discount and payment date

A discount only works when it has an expiration date attached to it. If your customers feel no time pressure to enjoy a discount, they wait. And they don't pay. Or even pay too late.

That's why you also assign an expiration date to your cash discount.

Your customer gets a discount, but must decide quickly.

What is fast? 5 days?

5 days is a little and a lot

The term you use for discount cash depends on your normal payment term.

Is that 1 week? Then it would be crazy to give your customer a discount if he pays within 5 days.

If your payment term is 30 days, 5 days is reasonable.

Extra tips before you start with cash discount

Calculate in advance whether discounts will not be to your disadvantage.

Once you give a customer a cash discount, they will expect it next time. Consider well in advance whether that is what you want and are able to do.

Are you using CoManage? Have the complicated calculation for discount cash calculated on your behalf.

Conclusion: Giving a discount to make customers pay faster. It's a change from threatening administrative fines for late payments.

Conclusion: you want, can and must avoid outstanding invoices. At all times.

Outstanding invoices needlessly drain your energy. Unfortunately, there are no watertight formulas and tactics to get every invoice paid on time.

What is certain is that as a business owner, you have a lot in your own hands.

Feel free to try some of the tips above. And keep in mind your experience, business and customers.

Meanwhile, we sincerely hope that these tips will give you more time to do what you love most.

Baking a cake, for example? If you read very carefully, you will already find 3 ingredients out of 4 in this article.