The payment reminder: 7 best practises

You kept your part of the deal and then customers “forget” to pay your invoice. As if you have nothing better to do than wait for money to arrive in your bank account.

And when that doesn’t happen, you need to act like a bully and send out a payment reminder. Unless… you apply the below.

7 powerful tips to turn payment reminders into cash

Apply our tips and you will have to deal a lot less with this ugly part of doing business. How do we know?

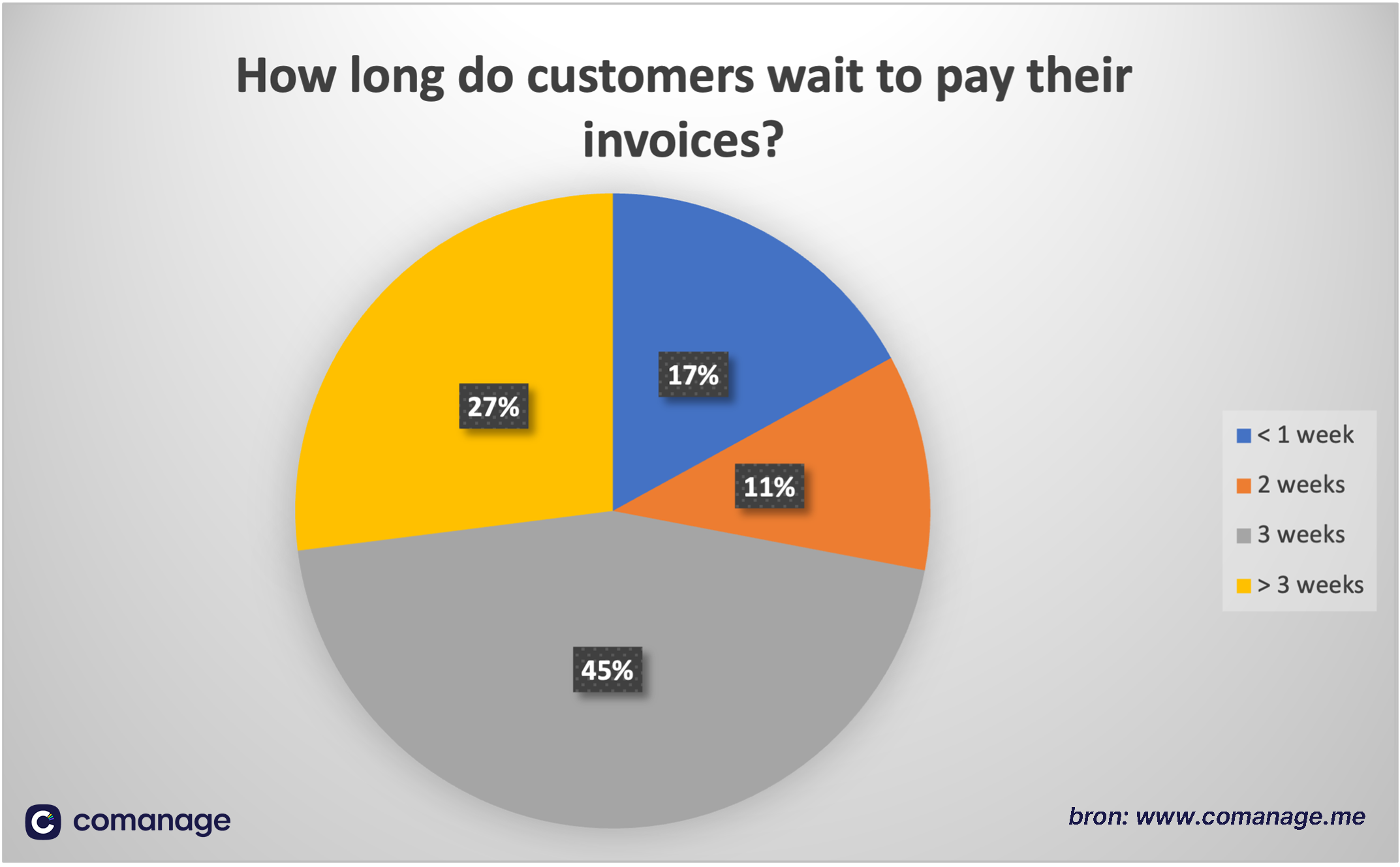

At the end of 2022, we conducted research amongst 436 freelancers and SMBs that use CoManage to create invoices. One thing that struck us was how little of them had to send payment reminders.

In the same research, we found out that a whopping majority (73%) of these businesses get paid within 3 weeks after sending an invoice.

In the same research, we found out that a whopping majority (73%) of these businesses get paid within 3 weeks after sending an invoice.

So, how can you achieve this too? What are the secret ingredients to deal less with chasing customers?

Spoiler alert: software is just one item on the list. So make sure you don’t miss the golden nuggets…

#1 Send your payment reminder ASAP

You can send a payment reminder before, on or after the due payment date of your invoice.

That means you have 3 opportunities to contact your customers to avoid outstanding invoices.

Remind customers before the invoice expires

This timing is not suitable for every business. It is typical for enterprises that have a large consumer base and use recurring invoices. Think of energy suppliers, telecom, internet providers, etc.

On the due payment day, then?

Although you could send your payment reminder the day after the due payment date, this may not be the best decision.

Banks are greedy monsters. They take money faster than depositing it in your account.

So when you don’t see a payment from your customer on the due date, it is possible that the money is on its way.

Imagine how you would look if you sent a payment reminder at that moment. It would be something between “impatient” and “the invoice police”.

There is nothing wrong with being strict in business, but customers have no control over how fast banks transfer money.

Or better wait a little longer before sending your payment reminder?

Postponing your reminder one more day after the due payment date can work. Provided:

This day is not on the weekend, or an official bank holiday.

Your invoice is not for an international customer. In that case, the bank transfer can easily take days.

In all cases, do not postpone it too long. If you do, you give the impression that

there is no hurry to get your money

or that your administration is a gigantic mess

You don’t want either of that, do you?

There is no rule that works for every business. But do not wait longer than 2 weeks at most to remind your customers of overdue invoices.

#2 Charge extra administrative fees

As a business owner, you assume customers read and agree with your terms and conditions. The brutal reality of unpaid invoices shows that this is an illusion.

But that doesn’t mean that you cannot cover your back. Mention the exact additional fees and costs in your terms and conditions.

What is a reasonable fee for overdue payments?

Deciding a fee to charge customers who pay your invoice too late is not a pure mathematical exercise.

There are two sides to the story.

Your client treated you badly and you want to punish them, somehow. It is your duty, as a business owner, to find the middle ground. These 3 options are the most popular (and reasonable) ones;

An interest calculated on an annual basis. The longer your customer waits to pay, the higher the fee.

A percentage of your invoice amount. Nice, but what about an invoice of 20 euros? Are you really going to charge pennies or cents?

A flat rate, but is, let’s say, 10 euros a reasonable fee for an unpaid invoice of several thousand euros?

You can combine these rules or consult with a lawyer or your accountant.

Once you have defined your fee, you still have the choice to apply it or not.

When to charge administrative fees for overdue payments?

You decide, of course, but if you answer “Yes” to one of the following questions, charge the fees.

Is this the first time the customer orders from you?

Would your business survive without this particular customer?

Is this not the first time the customer is paying too late?

If you’re using CoManage, you can easily look up this information in your client information sheets.

It is easier to move forward when you don’t carry heavy luggage.

Charging a fee has two potential advantages for you:

Next time, your customer may pay you in due time.

Somebody will at least compensate for your lost time and extra stress.

Omit charging administrative fees?

A loyal customer is probably worth more to you than the fee you can legally charge for unpaid invoices.

Even if you have foreseen it, nobody forces you to apply your own business rules.

However, you can mention explicitly that you will NOT charge extra costs to handle the late payment. This way, you show goodwill.

And what’s even more: you remind customers they made a tiny mistake, but that you can forgive them.

#3 Demand immediate payment

Your customer didn’t pay your invoice. It would be a terrible mistake to mention another due payment date in your reminder.

Why?

Let’s face it. Your first deadline to pay didn’t move the needle. What makes you believe that a new payment date will?

However, if your relationship with your customer is at stake, you can show some goodwill. But not too much.

Let’s assume the following scenario for a service provider:

Your payment period for invoices: a generous 30 days.

You only invoice your customer after you have finished the job.

The project took you 2 weeks.

After 44 days (30+14), you still don’t have the money you deserve.

Are you really going to allow a delay of 30 more days? Or rather one week?

What if this would happen with 5, 10 or even 20 customers?

How long will your business be able to operate in that case?

You get the point.

Even one overdue payment can be fatal for a freelancer or a small business. Make sure you are not that one.

If you produce and / or sell goods, the situation is slightly different.

You pay upfront for the production or purchase.

This implies you have built up a financial reserve in advance.

No payment, no delivery.

Upfront payments are more common for goods than for services.

#4 Don’t give up after one reminder to pay

It is crucial that you send at least one payment reminder. Do not count on the kindness of your customers.

Even if they are loyal, you won’t harm your reputation. Some customers really forget to pay you in due time.

The new manager is trying to adjust the workflow.

They switched their invoicing program, or accountant.

Changes of address, or even the company structure.

Unforeseen circumstances, such as illness, a hacked system and whatnot.

Do yourself and your bank account a favour. Send at least one payment reminder.

And do not send more than 2. If the message is not clear after 2 reminders, you need to change gears.

A debt collection agency. This is their job.

You can have a payment letter drafted by a lawyer. If this doesn’t impress your customer, you will probably never get your money.

Specialised service providers won’t do this for free. Also, if the situation escalates, you can bring this to court. That will cost more, with no guarantee you will ever see your money.

The biggest favour you can do to your business? Talk with a business lawyer to compose, or review, your general terms and conditions. Make sure you explicitly mention your payment conditions and sanctions when customers don’t respect them.

Then, also make sure you include these in your invoices and even your quotations.

Don’t be afraid of hiring specialists to collect overdue payments. Your customers hired you too because you are a specialist in your field.

In all cases, use your brain and gut feelings.

Some customers will feel offended and never ever do business with you again. That’s their bad. Your consciousness is clear because you did the job, you had patience, you were reminding them in a friendly way…

#5 Consider the way you send a payment reminder

The way you send your payment reminder highly influences how fast you will get your money.

Basically, you have two options: email and snail mail. So, which one is the best?

That depends.

A payment reminder only stands a chance if the customer actually receives it.

Sending payment reminders by post

In the digital age, letters are bound to get attention. If you send payment reminders by post, there is a huge chance the recipient will at least open the letter.

Printing and sending letters is more expensive than email. It also requires more effort from you. But that is a small price to pay.

Registered mail is probably an even better option.

Along with your “please, pay” message, you also send a loud signal that you are tracking the delivery of the letter.

In other words, you have legal proof that the customer DID receive your payment reminder.

Sometimes, the post is not the recommended way.

The mail service in your country is, let’s say, buggy. Unreliable, late, too expensive.

If your customer is living abroad, there is an extra cost and risk of letters not arriving. In that case, you can consider a courier service to drop off your payment reminder at the door.

Sending payment reminders by email

Emails are, for many reasons, the preferred way to communicate with customers. It is absolutely normal to use this channel to remind customers of their duties.

If you are lucky, you live in a country where registered emails are legal proof in court. That can come in handy in the worst-case scenario.

Another option is to use an email template for your payment reminder. Then you send your reminder by email without even opening your email program. What makes it even easier is the build-in Chat-GPT integration. You can ask AI to help you with the email text.

Yes, that is possible and easy.

If you create an invoice with CoManage, you can send it with one button.

The same goes for your payment reminders. Your customer will receive an email as if you sent it directly.

Sending payment reminders really doesn't get any easier than that.

#6 Don’t rely on your memory or agenda to remind customers to pay you

For sure, you have better things to do than remember when customers need to pay you.

Your memory requires energy and you'd better turn that into making money than dreaming about the money customers owe you.

Also, a digital calendar is not the tool you want to follow up payments.

Planning: you created an invoice and now you need to enter the payment date in your calendar.

Maintenance: when a customer paid your invoice in due time, you need to remove the reminder from your calendar.

Interruptions: you had planned to work, but suddenly your day is filled with the boring task of sending payment reminders. At these moments, you can say goodbye to all the positive energy you had hoped for.

So, what is your best alternative?

A clear overview of all your invoices in one place.

How you do this is completely up to you.

If you prefer to create your invoices with excel, you can best create a master spreadsheet that contains all details, including the due payment date.

Or you can make your business and life even easier…

#7 Use invoice software to send payment reminders. Automatically or manually.

Invoicing software, such as CoManage, saves you tons of time when creating, managing and following up due invoices. And yet, we saved this tip as the last one in the row.

The reason?

Blindly relying on software to fix payment issues is risky.

You will get the best results - customers paying outstanding invoices - when you apply the previous best practices with a handy tool.

That said, CoManage offers two ways to manage due invoices.

Send payment reminders automatically

The set and forget option is ideal if you connect your bank account with your invoicing software. You can use, for instance, Ponto which is compatible with CoManage.

If money is transferred to your account, the invoice will automatically get the “Paid” status.

If it is overdue, our software will automatically send your customer a reminder.

Send payment reminders with one click

We recommend this option for two cases.

If you don’t mind following up payments manually.

If you want complete control over the timing of your payment reminders.

Once you see a red status next to an invoice, you can click on the button.

We sincerely hope that our tips will help you fix the annoying cash flow problem fast. If you want to get a taste of what else CoManage can do for your business, you can give it a free ride.